Bond Duration – How to Calculate Interest Rate Risk for a Bond

Whether you are taking a conservative or an aggressive approach towards investing, your portfolio likely includes bonds. Like any responsible investor, you decide to read up on bonds, and that’s when you come across the bond duration, an important aspect of the investment that determines how long it will take to receive the price of the bond from its cash flow.

It sounds simple, but it’s a little complicated than that. In this piece, we review everything you should know about the term as you prepare to immerse yourself into bond investment.

-

-

Featured Bonds Broker 2020

- Minimum deposit and investment just $5

- Access to Bonds, as well as Stocks and Funds

- Very user friendly platform

What is bond duration?

Duration is the measure of how long it takes to get to the bonds id point in terms of cash flow. For instance, if a company specifies the bond duration is 3.6 years, it means that you will get back your original investment within that time through payments of coupons.

We agree that this sounds just like bond maturity and the fact that they are both measured with respect to time doesn’t help the situation. But let’s get over what they sound like and focus on what they actually mean.

Bond maturity is how long the bond investment lasts, while duration is more of a measure of the sensitivity of the price of bonds with respect to change in interest rate. It’s worth noting that bond maturity is linear and doesn’t change depending on the interest, but the bond duration is non-linear, and as maturity reduces, it accelerates.

How Does Bond Duration Work?

Based on the above descriptions of duration, we can deduce that the higher the duration, the larger the change in bond price when interest rates increase. In layman’s terms, the higher the duration, the higher the risk. Generally, for every 1% interest change (up or down), the price of the bond changes with about 1% as well in the opposite direction for every year of bond duration. So if your bond duration is five years, and the interest rate increases, then the bond price will drop 5% and if the interest rate decreases by 1%, the bond price will increase by 5%.

Several factors that can affect your bond duration include;

Bond maturity

Longer maturity is synonymous with higher duration and, consequently, a high-interest risk. Let’s say you have two bonds before you; they each have a 5% interest rate and cost $1,000 but have varying maturities. The bond that matures faster probably in a year will repay the true cost of the bond faster than one that takes ten years to mature.

Note: Bonds with shorter maturities have lower durations and therefore reduced risk.Coupon rate

This is the interest rate payable on a bond. It is the rate that applies annually, from when you purchase the bond until it matures. If you have a $100 bond with a coupon rate of 10%, it means every year you get $10 until the bond matures. If the coupon rate is semi-annual, you’ll get 5% every six months until the bond matures. The yield, in this case, is the total coupons paid by bond maturity.

The coupon rate is factored in when calculating duration. If you have two similar bonds but with different coupon rates, the bond that has a higher coupon rate will pay back the original cost faster than the one that has a lower yield. Generally, high coupon rates go hand in hand with low durations and low risks.

In practice, there are several types of bond duration, including Macaulay, Modified, and Effective. Though they all point to the same thing, they are calculated differently and expressed in different figures. Most investment platforms like eToro will do the calculations for you, but as a responsible bond investor, you ought to at least have a working idea of the calculations.

Types of Bond Duration and Examples

Macaulay Duration

This refers to the length of time it takes you to recover the money you invest in the bonds through coupons. It simply tries to give an estimation of the time it takes to recoup the price of the bond from the cumulative cash flows.

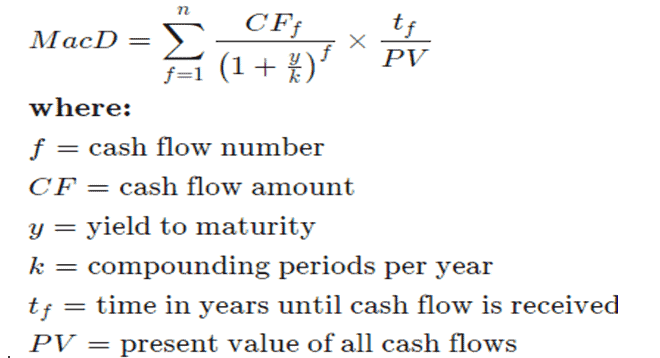

And since this duration is a partial function with respect to bond maturity, the higher the duration, the higher the interest and risk involved. You can calculate the Macaulay duration with the below formula:

This formula is available into two sections – the first section, which is the present value of future cash flows, and the second part, which is the weighted average time until all cash flows are paid. Combining these two sections shows you how long it will take to get back the bond price from cash flows.

For instance, if you buy a bond with a 6% coupon rate, three years to maturity, an 8% yield to maturity, and priced at 95 for each 100 of par, the Macaulay will be 2.82 years.

Modified duration

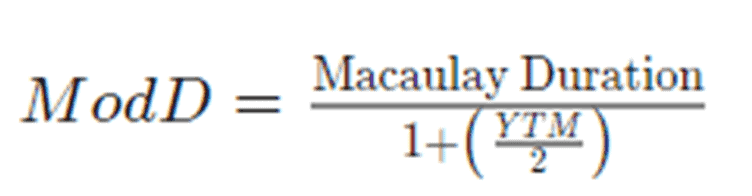

Now, this is slightly different from Macaulay’s duration. It helps you understand how the bond’s price will increase and decrease with the Yield to Maturity (YTM) fluctuations of 1%. This duration is important, especially if you are concerned that the interest rates will change soon.

If the bond has a semi-annual coupon payment, then the modified duration calculation is:

But if the coupon payment is annual, you don’t divide the YTM by two.

If you feed the figures from our previous example into the new formula, you will get $2.61. This means that if the YTM increases from 6% to 7% or reduces from 6% to 5%, the bond price will increase and decrease respectively by $2.61.

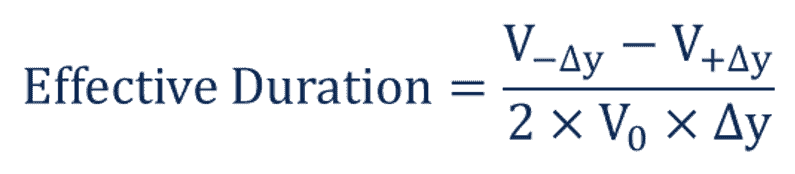

Effective duration

If your bond has some extra options attached to it say it is callable or puttable before maturity, then the effective duration considers them in its calculations. It entertains the fact that these options provided by you or the bond issuer will affect the cash flow and hence the bond duration.

Where:

- V–Δy – the bond’s value if the yield falls by y%

- V+Δy – the bond’s value if the yield rises by y%

- V0 – the present value of all cash flows of the bond

- Δy – the yield changes

So if you have a bond with 100 as its face value, with a semi-annual coupon rate of 7% and five years tenure, the effective duration will be 4.160275.

You can also calculate the Macaulay and Modified duration from the above example using the formulas provided. You will get 4.3038 and 4.158303 for the Macaulay and Modified duration, respectively.

Note: When you look at duration, you can tell a lot about the bond. For instance, if the bond bears interest, the duration will always be lower than the bond maturity, and if the bond doesn’t pay coupons, then the duration is equal to the maturity. Also, any bond with high yield will have a low duration in comparison to those with low yields.Usefulness of duration

You ought to be aware of two types of risks that affect your bond investment, these are credit risk and interest rate risk. So what are these?

Credit risk

It is simply the probability of loss from failure to pay as per the contractual obligations. In this case, usually, this term is used in loans and though there is no way for a lender to know if the borrower will default, they can run some assessments which can help manage and reduce the credit risk involved. Some companies evaluate the credit risks of potential and current customers on behalf of lending companies. Advancements in technology also allow businesses to analyze data fast and assess a customer’s profile.

Here we are dealing with bonds and not loans, though from the perspective of the bond giver, it can be a loan. If you consider buying a bond, you should review the credit rating of the said bond. If it has a low rating, B and below, the bond issuer has a higher risk of default. On the flip side, if the rating is high, an A, AA, or an AAA, then the bond is a safe investment. Luckily for you, there are bond credit agencies that continually monitor corporate bond issuers.

From this, you might think that bond investors will always go for low-risk bonds, but that’s not the case. It all breaks down to the type of bond investor one is. A risk-seeking investor will purchase bonds with low credit risk rating in the hope of getting high returns while a risk-averse investor will opt to purchase a low-risk bond.

Interest rate risk

This is the danger the bond value suffers when the interest rate changes. You can reduce the interest rate risk by purchasing bonds that will mature at different times. Long term bonds usually have a maturity risk premium in the form of a higher return, which compensates you for the additional risk of interest rate changes with time.

Interest rate risk affects a myriad of investments indirectly. However, it directly affects bond value. And because of this, you should always keep a close eye on the interest rates. Generally, when the interest rates increase, the bond price plummets, the opposite is true.

So how does duration tie all these together? Well, it helps you to quantify the potential impact of the above factors on your bond price. For instance, if a company starts to struggle, and the credit quality drops, you will need a higher reward or Yield-to-Maturity for the bonds and for the YTM of existing bonds to increase, the bond prices need to fall.

Note: Credit quality is the measure of the likelihood of a bond issuer to repay the loan. Credit quality is determined by independent rating agencies and range from high to medium to low (AAA to C).Duration Strategies

In your research, you might have come across short-duration and long-duration strategies. Analysts and experts investors like to engage in lengthy debates on these two. If you have no clue what they are, you can get lost in all the financial jargon. Luckily for you, we are here to make things a little simpler.

From an investment context, ‘long’ describes a position where you own an underlying asset whose value is expected to increase if the price increases. On the other hand, ‘short’ describes a situation where you borrow an asset or where you have an interest in an asset, which will increase in value when its price takes a dip.

So which is a better strategy between the two? Unfortunately, the answer is not as simple and direct. You see, a long duration strategy represents an investment strategy where you focus on the bonds that have a high duration value. In such a situation, you will most likely purchase bonds that have a long time before maturity. This means that they will be exposed to high-interest rate risks. This type of strategy is ideal when the interest rates keep falling. A perfect example is during a recession.

On the other hand, a short-duration strategy is one where you focus on purchasing bonds that have a small duration. This means that you’ll focus your efforts on bonds that have a short time before maturity. This strategy is perfect if you expect the interest rate to skyrocket or when you are unsure of the future of the rates. A short-duration strategy is all about reducing your risk.

Limitations of Bond Duration

Now, though bond duration offers great insight into what you should expect from bonds, it is not a foolproof analytical tool for bond risk. For instance, duration doesn’t tell you anything about the credit quality of a bond or the bond strategy you are thinking of using. This is especially important when you are dealing with low-rated securities, including high-yield bonds. These will react as much, if not more, to your concerns about the bond issuer stability as they will to interest rate changes.

As you use duration, you should note that the average duration might change as the interest rate changes, and the bond matures. This means that the duration calculated upon bond purchase may not be the same or accurate after some adjustments. To stay on top of things, you will have to constantly check the average duration of your bond strategy. Alternatively, you can opt to invest in actively managed strategies.

Broker Fees

Aside from duration and credit risk, you should also consider the fees a bond broker will charge, this is if you will not purchase from an underwriter. You should always ensure you are getting a fair deal by taking advantage of data that is publicly available regarding the bond price, interest rates, and maturities.

This talk of broker fees brings us to how you choose the best broker in the US., but before we dive into that, here is a quick breakdown of how you can buy bonds.

How to purchase bonds

There are several methods you can purchase bonds, but bear in mind that the sellers are not all equal.

- Via the US Treasury – you can purchase Treasury bonds online by going to the Treasury direct on your browser. You will need to set up an account to proceed. Account creation requires that you be 18+ years and be legally competent to make transactions. You’ll also need an SSN, a physical US address and a US bank account. The Treasury doesn’t mark up the price of the bond, and it doesn’t collect fees either.

- Via a broker – as you’ll see below, there are many online brokers who sell treasury bonds, municipal bonds, and corporate bonds. Brokers like TD Ameritrade and eToro have extensive bond lists and though they help you through the process and offer support in case you are stuck or need some explanations and investment guidance, buying through them is not as straight forward as purchasing bonds through Treasury Direct. Also, the prices of the bonds will vary from one broker to another, owing to markups, markdowns, and transaction fees.

- Via an ETF or a mutual fund – bond funds are great, especially if you don’t have money to spend on several individual bonds. Usually, individual bonds are big and costly, but with bond funds, you can purchase a diverse array at a reduced cost. The catch is that bond funds don’t have specific maturity dates and because of this, the interest payments vary, and the resulting income is unpredictable.

Best Bond Brokers

There are many online brokers, but very few are worth your time and money. Here is a quick list.

StashApp

This is one of the few bond brokers based in the US., but not only do they allow you to trade in bonds, but you also get to trade in funds and shares as well. What we love about the platform is the fact that they paid attention to the design. It is easy to navigate to different sections on the site, and the process of trading is simple and if you ever find yourself on the road, you will appreciate the user-friendly mobile application they’ve made available. As if that’s not enough, the platform allows you to make investments from as low as $5. If you are new to bonds, this is a great way to learn without losing much.

To invest on the platform, you download the application on your phone, register an account, and go through the verification process. After verifying your account, you can fund the account and choose the bonds you want to invest in.

As for fees, you should know several things. Though the platform allows you to invest a minimum of $5 if your account has less than $5,000, you’ll incur a $1 monthly fee and if your account has a lot more money, you’ll be charged a 0.25% annual fee.

Our Rating

- It is ideal for beginners

- It as a $5 minimum investment rue

- The platform is user-friendly

- The mobile app isn’t supported on Blackberry and Windows devices

- It doesn’t have an investment management

- The ETF expense ratio is high

Ally Invest

Ally Invest is a platform backed by Ally Bank, a reputable institution in the US. The stockbroker makes investing in bonds and other products a piece of cake. Some of its main selling points include that it has low fees, and it grants you access to a trillion-dollar bond industry. You can invest in shares, stocks, options, mutual funds, and ETFs. This bond broker firm is designed for the US population alone.

Our Rating

- It accepts US bond investors only

- It is regulated

- It has the backing of a popular financial institution

- It doesn’t have a demo account

- You can only trade on the US market

- Forex trading is only available through a different account

Fidelity Investments

This is a huge stockbroker company. Experts estimate it to have assets worth more than $2.4 trillion. In addition to having its own mobile platform, it offers an intuitive web platform and even though the fees are higher than what most brokers charge, you can trust that your money and investment is safe.

Our Rating

- It is regulated

- It is a large and reputable institution

- It doesn’t have a minimum investment limit

- Opening an account is a tedious process

- The financing rates are high

- The mutual fund fees are high

Conclusion

The bottom line is that the bond duration tells you how sensitive the bond is. Though you don’t have to learn how to calculate the bond durations (some online calculators that cater to this), you must understand what they mean and how they affect the bond investment you make.

As you start your bond investment journey, you should check out bond brokers in the US. Do some research comparing which broker gives the best terms and support.

Featured Bonds Broker 2020

- Minimum deposit and investment just $5

- Access to Bonds, as well as Stocks and Funds

- Very user friendly platform

FAQs

What is the duration of a zero-coupon bond?

The duration of a zero-coupon bond is the same as the bond maturity.What is the difference between duration and convexity?

Duration assumes the relationship between the change in the interest rate and the bond price is linear. This means that regardless of the direction of change of interest, the change in bond price is the same. On the other hand, convexity measures change in bond duration in response to the change in the interest rate.Is long-duration better than short-duration?

Not necessarily. The preference depends on what kind of investor you are. If you are a risk-taker, then a long duration is better. But if not, then a short duration is preferred.Thadues

Thadues

View all posts by ThaduesThadeus Geodfrey has been a contract writer for Lernbonds since 2019. As a fulltime investment writer, Thadeus oversees much of the personal-finance and investment-planning content published daily on this site. With a background as an iGaming expert and independent financial consultant, Thadeus’s articles are based on years of experience from all angles of the financial world.

WARNING:

För att använda sidan måste man vara minst 18 år. Om du behöver hjälp eller rådgivning angående spelproblem, vänligen kontakta Stödlinjen.

Vi kan ibland inkludera affiliatelänkar i vårt innehåll. Genom att klicka på dessa länkar kan vi erhålla en provision – utan extra kostnad för dig.

Det är viktigt att notera att innehållet på denna webbplats inte ska betraktas som spelråd. Spel är en spekulativ verksamhet där ditt kapital är i risk. Vi erbjuder denna webbplats gratis, men vi kan få provision från de företag som vi presenterar här.Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkPrivacy policyScroll Up