By Michael M. Terry, CFA – Founder Rubicon Associates

(May 2012) Energizer Holdings (ENR) was in the bond market today with ten year debt that is interesting and priced attractively.

Despite my catchy title, Energizer is involved in much more than batteries, although many may not realize this fact.

The Company

Energizer Holdings, Inc. is one of the world’s largest manufacturers and marketers of primary batteries, portable lighting products and personal care products in the wet shave, skin care, feminine care and infant care categories. Their products are marketed and sold in more than 165 countries around the world.

- The Personal Care division includes Wet Shave products sold under the Schick, Wilkinson Sword, Edge, Skintimate and Personna brand names, Skin Care products sold under the Banana Boat, Hawaiian Tropic, Wet Ones and Playtex brand names, and Feminine Care and Infant Care products sold under the Playtex and Diaper Genie brand names.

- Energizer’s Household Products division manufactures and markets one of the most extensive product portfolios in household batteries, specialty batteries and lighting products. (Trivial fact: Energizer invented the first D cell battery in 1893)

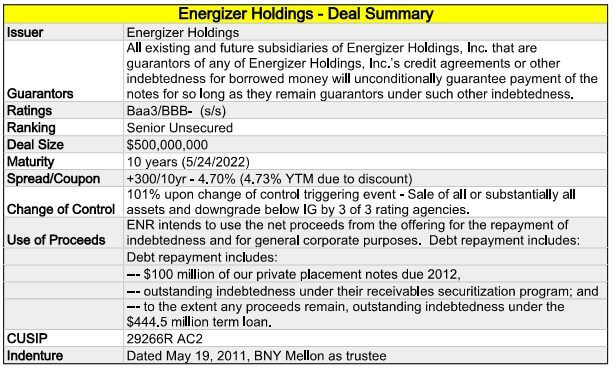

The Offering

The prospectus can be found here.

Bond Covenants:

Change of Control. Upon the occurrence of a Change of Control Triggering Event the indenture provides that each holder of notes will have the right to require the company to purchase all or a portion of such holder’s notes at a purchase price equal to 101% of the principal amount thereof plus accrued and unpaid Interest. “Change of Control Triggering Event” means the notes cease to be rated Investment Grade by at least two of the three Rating Agencies.

Limitations on Liens. The company will not, and will not permit any of their Restricted Subsidiaries to, create, incur, issue, assume or guarantee any indebtedness for money borrowed secured by a Lien upon any Principal Property or any shares of stock or indebtedness for borrowed money of any Restricted Subsidiary, whether owned at the date of the issuance of the notes or thereafter acquired, without effectively providing concurrently that the notes are secured equally and ratably with or, at the Company’s option, prior to such Secured Debt. The Company can, however, can create liens or secure debt as long as the aggregate amount does not exceed 15% of Consolidated Net Tangible Assets as shown on the Company’s consolidated financial statements as of the end of the fiscal year preceding the date of determination. (Principal properties are properties of Restricted Subsidiaries located in the United States with a gross book value of greater than 2% of consolidated net tangible assets).

This is standard language for IG debt.

Consolidation, Merger, Conveyance, Sale of Assets and Other Transfers. Energizer Holdings may not consolidate with or merge with or into, whether or not we are the surviving corporation, or sell, assign, convey, transfer or lease our properties and assets substantially as an entirety to any person, unless:

- the surviving corporation or the person acquiring the assets is organized and existing under the laws of the United States or one of the 50 states, any U.S. territory or the District of Columbia, and assumes the obligation to pay the principal of, and premium, if any, and interest on all the debt securities, and to perform or observe all covenants of the indenture;

- immediately after the transaction, there is no event of default under the indenture; and

- Energizer delivers to the trustee a certificate and opinion of counsel stating that the transaction complies with the indenture. (Section 10.1 of the indenture).

There is no real teeth in this covenant as the company can consolidate, merge… as long as the survivor assumes the obligations under the indenture and is organized and existing under the laws of the United States.

Debt Guarantees. Except as otherwise described in the applicable prospectus supplement, each guarantor will jointly and severally guarantee (i) due and punctual payment of the principal and interest and performance of all other monetary obligations and (ii) in case of an extension of time of payment or renewal of any such debt security, that the guarantee will be paid in full when due in accordance with the terms of the extension or renewal. If the Company fails to make any payment, a guarantor of such debt will be obligated to pay the payment immediately. Except as otherwise described in the applicable prospectus supplement, no guarantor may consolidate with or merge with or into another individual or entity unless (i) the successor to a consolidation or merger unconditionally assumes all obligations of such guarantor; and (ii) no event of default has occurred.

Subsidiaries that DO NOT guarantee the debt constituted approximately 48% of Energizer’s total consolidated revenues and had approximately 42% of their total consolidated assets.

Bank Covenants:

In addition to knowing the covenants contained within the debt, investors should also know the covenants contained within the bank lines/loans.

The revolving credit agreement provides for a 5-year revolving credit facility in an initial amount of up to $450 million outstanding at any time. As of March 31, 2012, there was no outstanding indebtedness under the revolving credit facility. The obligations under the revolving credit facility are unsecured and are fully and unconditionally guaranteed by the same domestic subsidiaries of Energizer which are guarantors of the notes offered hereby. The revolving credit agreement contains the following financial covenants (the terms used being defined in the revolving credit agreement):

- Maximum Leverage Ratio. The ratio of (i) all indebtedness of us and our subsidiaries (other than certain indebtedness related to the receivables securitization program) to (ii) EBITDA may not exceed 3.50 to 1.00, subject to exceptions which would allow such ratio to be as high as 4.00 to 1.00 for certain periods of four successive quarters; and

- Minimum Interest Expense Coverage Ratio. The ratio of (a) EBIT of us and our subsidiaries to (b) total interest expense shall be greater than 3.00 to 1.00 as of the end of each fiscal quarter for the four-quarter period then ended, calculated on a pro forma basis with respect to permitted acquisitions.

Term loan covenants are essentially the same as the credit facility.

Private Placement Covenants

Energizer has accessed the private placement market (debt negotiated directly with lenders, often insurance companies) multiple times. At March 31, 2012, there was $1,265 million outstanding under the private placement notes. The obligations under the private placement notes are unsecured and are fully and unconditionally guaranteed by the same domestic subsidiaries of Energizer as the notes. The private placement notes contain the following financial covenants:

- At no time shall the ratio of consolidated total indebtedness at the end of a fiscal quarter to EBITDA for the most recently completed four fiscal quarters exceed 3.5 to 1.0, except that, if Energizer pays specified additional interest, the ratio may exceed 3.5 to 1.0 but be no greater than 4.0 to 1.0 for a period of not more than four successive fiscal quarters; and

- No restricted subsidiary may incur indebtedness if it would result in priority debt outstanding to exceed 25% of our consolidated total capitalization.

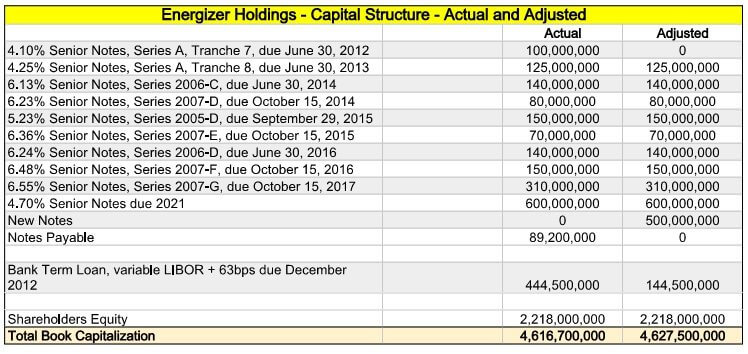

Capital Structure

With the covenants and contracts out of the way, the capital structure – actual and adjusted – looks like this:

Note: I paid off the note payable, the 2012 privates and $300MM of the term loan with the $500MM proceeds. There is no guarantee they will behave in a similar manner although it follows the use of proceeds.

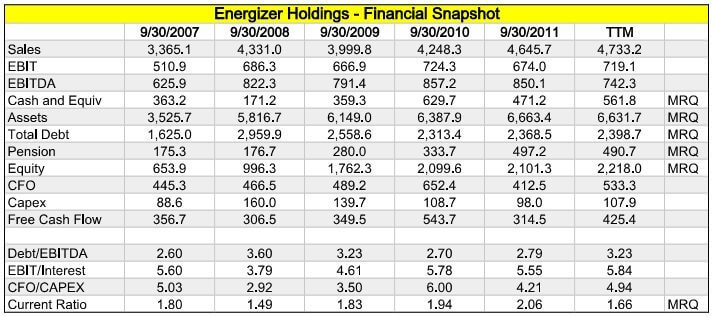

Financial Snapshot

The following table presents a financial snapshot of Energizer Holdings as well as some key metrics:

As the table shows, ENR has increased their leverage lately, but it still falls within all of their covenanted levels. As well, the company continue to be able to cover capital expenditures with cash generated from operations and runs free cash flow positive. The financial picture presented above is consistent with a mid to low BBB rating. While there is potential ratings upside, it is not a near-term outcome.

Debt Maturities

Energizer’s debt maturities are well laddered and should not present any repayment/refinancing issues.

Note: While the new issue is included in the schedule, existing debt that should be repaid with the proceeds is also included as it has not been paid yet.

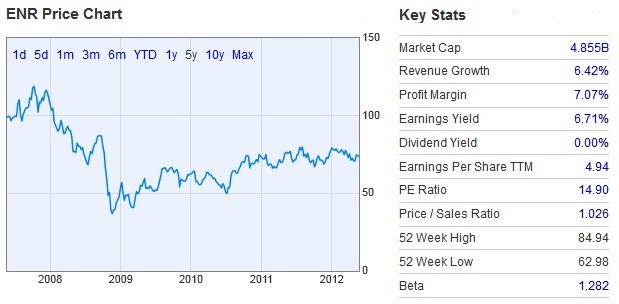

Equity Snapshot

The following is a profile of Energizer’s equity in order to get a feel for the value afforded the equity.

Source: YCharts.com

Bottom Line: Energizer Holdings is well positioned within their business lines and has a financial profile consistent with their ratings. The bonds are cheap relative to their ratings and to where peers trade due to the fact that the company is not a frequent issuer and bonds are usually put away and trade infrequently (the liquidity premium). While spread performance is somewhat limited due to the size of the deal and the expected liquidity, if viewed as a core holding, the yield will be additive to portfolio performance as well as add diversification.

————-

Research conducted by Rubicon Associates. Mr. Michael M. Terry, CFA is the Founder/Principal of Rubicon Associates LLC and has nearly 20 years of experience in the investment management industry focused on the analysis, investment and management of fixed income and preferred stock portfolios.

This article is for informational purposes only, it is not a recommendation to buy or sell any security and is strictly the opinion of Rubicon Associates LLC. Every investor is strongly encouraged to do their own research prior to investing.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account