Government Bonds | Invest in Goverment Bonds Today!

A government bond is a low-risk investment where you loan your money to the government. It is regarded as fixed income security because you earn a fixed amount of interest regularly for the duration of the bond. The government issues these bonds to raise funds to support projects or day-to-day operations.

Since the government backs the bonds, they do not lose value easily. The maturity dates of the bonds can vary from one year to 50 years, after which you will receive the original principal amount.

Read on to find out more how government bonds work, how much you can earn and more.

Featured Bonds Broker 2020

- Minimum deposit and investment just $5

- Access to Bonds, as well as Stocks and Funds

- Very user friendly platform

What are government bonds?

Government bonds are contracts that indicate that the US government will pay back the amount you have invested at an agreed interest rate for a specified amount of time. The interest rate is mostly referred to as the coupon rate. One of the biggest advantages of investing in government bonds is the low risk it entails. However, compared to other kinds of investments like corporate bonds, the rate of return in government bonds is low.

These bonds have a maturity period of one year up to 30 years, after which you will get back the face value of the investment.

What are the pros and cons of investing in government bonds?

Pros

- Low default risk

- Exempted from local and federal taxes

- Easy to buy and sell government bonds

- Extremely safe

- Periodic interest income

Cons

- Relatively low yields

- Interest rate risk

Featured Bonds Broker 2020

How do government bonds work?

Most people will be shocked to learn that the government from time to time does not have enough money to run projects and pay bills. The taxes collected by the US government cannot cover the wide range of government obligations, and printing more money may easily lead to inflation. To solve this dilemma, the government sells bonds to cater to the deficit in the federal budget and raise capital for projects. The government also uses bonds to control the money supply in the market.

When the government repurchases the public’s money in the form of bonds, the money supply in the economy increases significantly. This is because sellers get funds to spend and invest in the market. The funds that the government deposits in banks are used to loan to companies and other people, which boost economic activities.

Types of government bonds

Treasury bills

Treasury bills or T-bills are short-term debt backed by the US Treasury. They have a shorter maturity date ranging from 4 weeks to 52 weeks. As a holder, you can cash out before the maturity date to receive the short-term interest gains. However, it is important to note that the longer the maturity date, the higher the interest rate.

These bills are sold in denominations from $1000 and above. However, in non-competitive bids, some bonds can reach up to $5 million. Since the bills are backed by the government, they are regarded as a secure and low-risk investment.

Through the Treasury Department, the government auctions the T-bills in a non-competitive bidding process. In this case, the prices are based on the average of the competitive bids received. T-bills are issued at a slight discount from the face value, which means that the purchase price is at a reduced amount of the par value. For instance, you can buy a $1000 T-bill at $950. Nonetheless, when the bill matures, you will get the full face value of the bond.

The interest you should expect to earn is the difference between the face value and the purchase price. Since T-bills are short-term, they do not regularly pay like in coupon bonds. However, the interest income earned from T-bills is exempted from local and state taxes.

It is possible to purchase previously issued T-bills on the secondary market through a broker. New T-bills can be accessed on the Treasury Direct site where auctions are held. These bills that are sold in auctions are priced in a bidding process.

Compared to other types of investments such as stocks, T-bills are safer. The fixed interest rate can be a stable source of income. However, the interest rate is highly influenced by the external market. For instance, if the interest rates in the market increases, T-bills become less attractive, which means holders will lose on the high rates. Even though T-bills have low default risk, they have lower returns compared to other types of investments such as corporate bonds.

Treasury note

This is another popular US government debt security that comes with a fixed interest rate and a maturity of up to 10 years. These notes are issued in a competitive and non-competitive bid. On the competitive bid, you can specify the interest rate you want. However, in a non-competitive bid, you will only accept the yield determined in the auction.

There is an extensive secondary market that makes the notes extremely liquid. Also, interest on the note is paid periodically until maturity. The most exciting thing is that local and state governments do not tax the earnings from the notes. Additionally, you can redeem the whole face value once the notes reach maturity.

The longer the maturity period, the higher the interest rate on the notes. Unlike other types of investments, the value of the note is determined by the sensitivity of the interest rate. In most cases, a change in these rates occurs on the normal yield curve or under the control of the central bank.

Also, the notes feature different levels of interest rates as sensitivity changes. The advantage is that if there is a price fall, it will occur at various magnitudes. This sensitivity change is measured by duration and expressed in terms of years.

An excellent example of a significant change in interest rates happened in December 2015. The Federal Reserve raised the federal funds rate by 25 basis points, which reduced the prices of outstanding notes and bonds.

Treasury bond (T-Bond)

This is a type of government bond that earns interest until maturity. It is issued by the government, where you will receive interest payments commonly referred to as coupon payments. Also, you will get the principal amount upon maturity. However, the payments are taxed at the federal level.

The maturity period of treasury bonds can range from 10 to 30 years. They are offered with a minimum denomination of $1000. The coupon payments are paid twice a year and are not taxed at the local and state levels. If the bid is non-competitive, the maximum amount you can purchase is $5 million. However, in a competitive bid, you can only buy 35 % of the offering.

In a competitive bid, the rate the bidder is willing to accept is clearly stated. On the other hand, in a non-competitive bid, you are guaranteed to get the bond but at a set rate. Once the auction is completed, the bonds can be traded in the secondary market.

Since the secondary market is very active, the treasury bonds are highly liquid. On the downside, the secondary market causes treasury bonds to fluctuate significantly in the trading market. As a result, the pricing levels are dictated by the auction and yield rates. For instance, an increase in the auction rates can cause the prices of Treasury bond prices to go down. Also, an increase in Treasury bond prices can lead to a decrease in the auction rate.

Treasury bonds are a recognized investment offered by the government. These options help form a yield curve in a fixed-income market. In most cases, longer maturities provide better rates than lower maturities. However, an increase in demand for longer maturities can cause the yield curve to invert where longer maturities offer lower rates than shorter maturities.

Featured Bonds Broker 2020

- Minimum deposit and investment just $5

- Access to Bonds, as well as Stocks and Funds

- Very user friendly platform

Treasury Inflation-Protected Securities (TIPS)

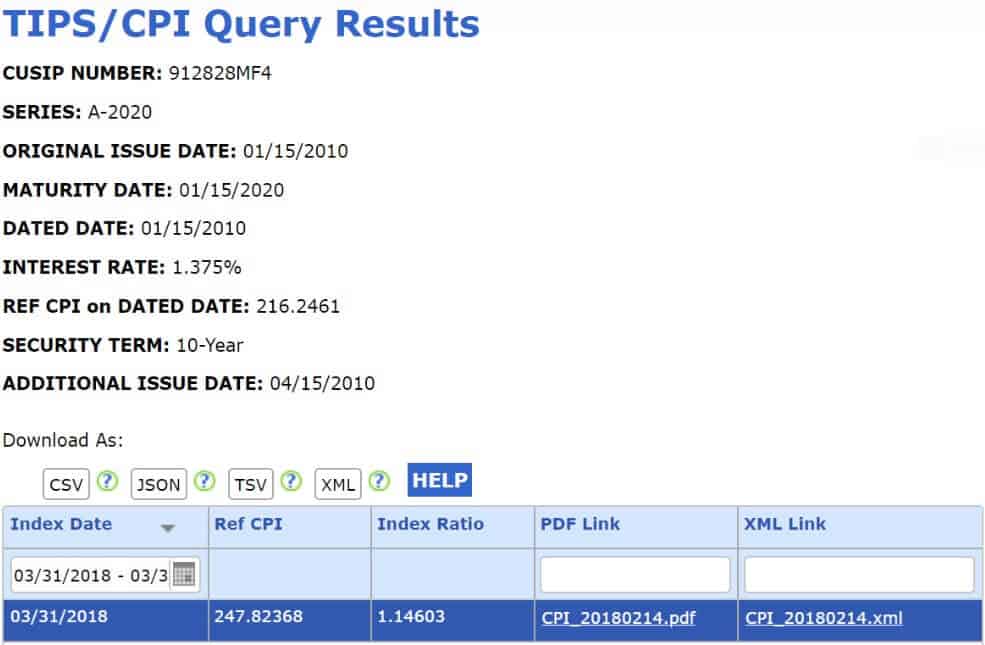

Treasury Inflation-Protected Security (TIPS) is a government bond/ debt security that is matched with the inflation with an attempt to protect the investors from the adverse effects of rising prices. This means that the principal value of TIPS will increase with the rise in inflation. Inflation is defined as the pace at which the prices of consumer goods increase across the economy.

A TIPS maturity period can range between 10 and 30 years and are considered safe because the government is involved. However, the interest payment offered can vary because the rate is applied to the adjusted principal. For instance, due to the rise in prices, the principal amount can be adjusted higher. As a result, the interest rates are multiplied to match the increased amount. This means that you will receive higher interest rates and coupon payments when the inflation rises. However, if inflation decreases, you will get lower rates.

You can purchase TIPS from the government through the TreasuryDirect system. The minimum investment is $100 and is offered with a maturity of up to 30 years. Alternatively, you can buy TIPS through a mutual fund or exchange-traded-fund (ETF). The advantage of purchasing the TIPS directly on the TreasuryDirect is that you will avoid the management fees involved with mutual funds.

The government uses TIPS to control the inflation risk that reduces the yields on fixed-rate bonds. Inflation risk is a significant issue since the interest rate on most treasury bonds is fixed. If the risk is not addressed, the interest payments may not keep up with the inflation. For instance, if prices increase by 3% and you pay 2% for the bond, you will have a net loss.

TIPS are designed to protect you from the adverse effects of inflation during the life of the bond. The principal value has been made to increase with inflation and reduce with deflation. When the TIPS you had bought matures, you will be given the original principal amount or the inflation-adjust amount.

Assume you own TIPS worth $1000 at the end of the year, and the coupon rate is 1%. If there is no inflation, you will receive $10 as coupon payment at the end of the year. However, if there is an inflation increase of 2%, your $1000 principal amount will be adjusted upward by 2%. While the coupon rate remains the same, it is multiplied by the adjusted principal amount.

To sum up, $1020 (adjusted amount) x 1% (coupon rate) = $10.20 (interest payment)

The reverse happens in case of negative inflation, also known as deflation. For example, if there is a deflation of 5%, the principal amount will be reduced by the percentage to become $950. As a result, you will be paid $9.50 interest payments at the end of the year. Nonetheless, at maturity, the principal amount will not be reduced and will remain at $1000.

During the life of a bond, the interest payments calculations are based on the deflation percentage. If you hold your TIPS to maturity, your principal amount will not reduce even if there is deflation. However, you might receive less than the principal amount if you sell your TIPS before the maturity date.

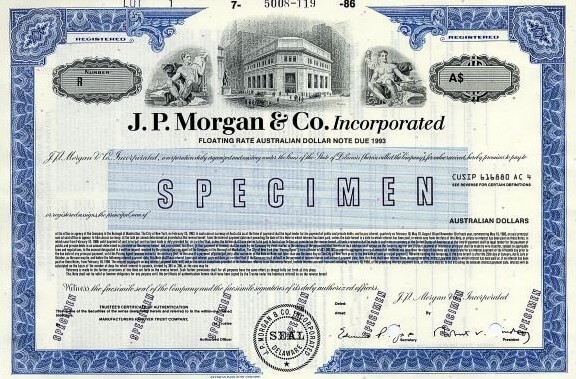

Floating-rate notes

A floating-rate note (FRN) is a government bond with a variable interest rate, which is tied to a benchmark rate. Some of the common benchmarks include the Federal Reserve funds rate, the US Treasury note rate, London Interbank Offered Rate (LIBOR), etc. Floating-rate notes come with a maturity period of 2 to 5 years and can be offered by the government, financial institutions and corporations.

Floating-rate notes or floaters play a significant role in the US investment-grade bond market. Unlike fixed-rate debt instruments, FRNs will enable you to benefit from an increase in interest rates. This is because the floater rates change periodically to the market rates. However, they are benchmarked against other short-term rates such as the Federal Reserve funds rate. This is the rate set by the Federal Reserve Bank to regulate short-term borrowing between banks.

In most cases, the interest rates you will receive increases with the length of time until maturity. As an investor, you will be compensated for holding long-term securities. For example, under normal market conditions, a bond with a maturity period of 10 years should have a higher interest rate than a bond with a one-year maturity.

Compared to fixed-rate debt instruments, FRNs have lower interest payments because they are benchmarked to short-term rates. You will give up a portion of your yields for the benefit of enjoying an increased investment as the benchmark rates rise. However, a decrease in benchmark rates will cause a reduction in FRN rates.

Savings bonds

A savings bond is a type of government bond that offers a fixed interest rate over a certain period of time. Since these bonds are not subjected to local and state taxes, many investors find them very attractive. However, savings bonds are non-negotiable and cannot be transferred.

Savings bonds can be traced back to 1935 when President Franklin Roosevelt allowed the Treasury to issue them. After the Second World War, more Americans were encouraged to take the bonds as a way to earn returns while enjoying the government guarantee.

Featured Bonds Broker 2020

- Minimum deposit and investment just $5

- Access to Bonds, as well as Stocks and Funds

- Very user friendly platform

How government bonds can help you make money

Government bonds are a type of investment referred to as fixed-income securities. Bonds are debt obligations where you loan the government a certain amount of money (principal amount) for a set period of time. In return, you receive a series of interest payments during the life of the bond. After maturity, you are given back your principal amount in full.

Coupon-paying bond

There are two main ways you can make money from bonds. You can buy the bonds directly from the government during the auction to hold them to maturity to benefit from the interest they earn. Also, you can purchase the bonds in mutual funds or exchange-traded funds (ETF).

Alternatively, you can get the bonds in the secondary market where previously issued bonds are traded. In most cases, the discount amount will depend on the number of remaining payments before the bond reaches maturity. Also, the bond price is affected by the interest rates in the market. Nonetheless, a secondary market is an excellent option for buying bonds if newer ones have low-interest rates. In either case, you will still the interest payments throughout the life of the bond.

For example, if you invest in bonds worth $1000 with a maturity of 10 years and a coupon rate of 5%, you will receive an interest payment of $50 every year. Since most bonds pay semi-annually, you will receive two $25 checks.

Zero-coupon bond

In a zero-coupon bond, you will not receive any payment for your investment until the bond matures. You will purchase the bonds for an amount less than the face value. However, when the bond matures, you are paid the whole face value. These bonds are also referred to as discount bonds, and the two typical examples are Treasury bills (T-bills) and US saving bonds.

Since most zero-coupon bonds have a pre-set face value, the amount paid at maturity is also pre-set. However, some of these bonds are inflation-indexed, which means the face value is confirmed at maturity. For instance, the amount can be influenced by factors such as the consumer price index.

How to buy government bonds

You can get the Government bonds directly from the US treasury, bank, broker or dealer. Below are the steps you should follow.

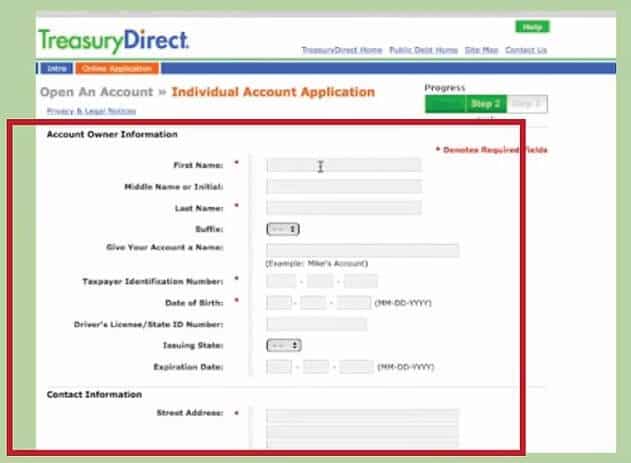

Step 1: Open an account

The first step is to open an account on the TreasuryDirect website. When you bid for a bond on TreasuryDirect, it is called non-competitive bidding. This is because you have to accept whatever yield is determined at auction, and you are guaranteed to receive the bond you want.

Step 2: Submit a bid

It is important to note that the whole bidding process is done online. On the site, click the BuyDirect button and follow the prompts to indicate the security type, amount and other information requested.

You can also reinvest your earnings into other securities on the website. For example, you can use your income from a maturing 20-year bond to buy another of the same type and terms.

Step 3: Buy bonds

The price of a bond will also specify its discount and interest rates. Go to the TreasuryDirect site, and visit the rates and terms section on the page. When you purchase bonds on the site, the funds will be withdrawn from the source you specify. Also, when a bond matures, your earnings are deposited into your bank or whichever way you specify.

How to cash in government bonds

To cash in your electronic EE and E bonds, you’ll first need to sign in to your TreasuryDirect account then follow the steps indicated there based on the type of bonds you have.

For Paper EE and E bonds, you can cash out at most local financial institutions. This is the simplest method to cash in bonds and get your money quickly.

Conclusion

Buying government bonds is a great way to join the investment world. The best part is that you are guaranteed to get your earnings since it is unlikely for the government to default on payments. Also, it can be a good source of income since the payments are sent semi-annually.

If you are not a big risk-taker, government bonds can be an excellent way to invest your hard-earned money.

Featured Bonds Broker 2020

- Minimum deposit and investment just $5

- Access to Bonds, as well as Stocks and Funds

- Very user friendly platform