By Dodd Kittsley, CFA iSharesBlog.com

When you work in the ETF industry you learn to follow the flows. But when I say that, I’m not only referring to the dollar amounts that are going in and out of funds. I’m also referring to the idea that you can gauge investor sentiment and their comfort level in using ETFs to express those sentiments by following the flows.

One area where this is clearly playing out is in the fixed income space. As I wrote in my last blog post, we think the fixed income ETF market has the potential to grow to $2 trillion in the next 10 years.

From late 2008 through June of this year assets in global fixed income exchange traded products (ETPs) nearly tripled – jumping from $104 billion to $303 billion. In the first half of this year, bond ETPs accounted for 40% of fund flows, helping to propel ETPs to their strongest first half inflows in history.

Skeptics of this trend have attributed the popularity of fixed income ETFs to low interest rates, and they contend that once rates rise, investors will flee fixed income funds.

At face value, those skeptics might seem to have a point. After all, short-term investors often follow the momentum of the market and can quickly shift from a risk off to a risk on trading mentality based on the latest headlines, economic report or Fed meeting.

But the numbers – the actual fixed income fund flows — tell a different story about investor behavior.

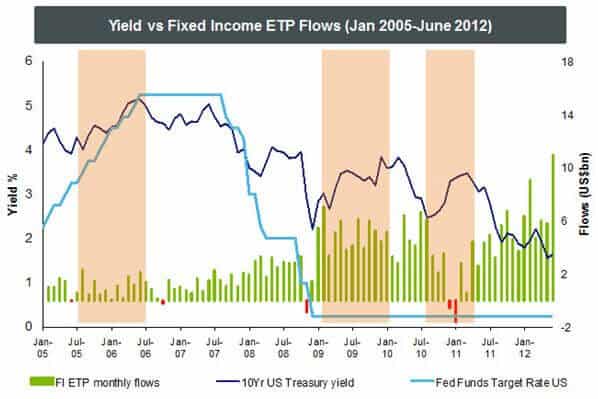

Take a look at this graph:

What we’ve found is that fixed income ETP flows have displayed stamina through recent periods of both rising and falling interest rates.

Let’s look at the period between mid-2005 and mid-2006. During that time, Treasury yields increased 126bps, but global fixed income ETPs gathered $13.3 billion, driven by demand for government and inflation-linked bonds.

Now, let’s look at the time between year-end 2008 and 2009. Ten year Treasury yields increased 160bps in that time and fixed income ETPs hauled in over $60 billion. The flows were led by government and inflation-linked bonds, as well as investment grade corporate and high yield bonds.

Lastly, between August 2010 and March 2011 there was another rate increase. While there were some outflows, the category gathered net inflows of $14.6 billion.

What does this tell us? Well, if you’re watching the flows they’re telling us that investors are becoming more comfortable using bond ETFs to express their investment views and position their portfolios for a range of economic scenarios. This, in turn, is spurring ETF providers to introduce new bond ETFs that allow wider access to this once opaque market. The two trends are pointing to an expansion of the bond ETF market regardless of the rate environment.

Also, keep in mind that many investors have a need to hold bonds in their portfolio regardless of the rate environment. Sure, tactical investors may shift into other asset classes if rates rise, but most investors purchase and hold bonds as a core part of a diversified portfolio. These investors may tweak their exposure over time, but they are not likely to substantially shift their holdings based on short-term trends. In the coming decade, we expect investor appetite for bond ETFs to be spurred by the income needs of an aging population, which will result in a larger allocation to fixed income assets.

At the end of the day we all know that interest rates will rise and interest rates will fall. But if you follow the flows, they point to an expanding, not a contracting, fixed income ETF landscape.

Sources: BlackRock Investment Institute, Bloomberg, Strategic Insight Simfund

Bonds and bond funds will decrease in value as interest rates rise.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account